Product and service records should contain sales tax information.

You can combine sales tax rates in QuickBooks Online (image above from current Sales Tax Center in QuickBooks Online, not the enhanced one). The customer will only see the total on an invoice or sales receipt, but QuickBooks Online will track each one accordingly for payment and reporting purposes If you are required to pay city, county, and state sales tax rates for a particular customer, for example, you can create a Combined tax rate that contains all of the individual components. This enhanced feature only supports accrual accounting. If you have sales tax set up right now and your situation is at all complicated, you’re going to want our help with the transition. The actual mechanics of the process are simple, but you’ll be moving historical and in-process data to a new structure. Intuit now offers a revamped version of QuickBooks Online’s sales tax features.Īt some point, you’ll be asked if you want to switch to the new, more automated system. You’ll need to see their exemption certificate or at least know its official number.

#QUICKBOOKS PAY SALES TAX PENALTY CODE#

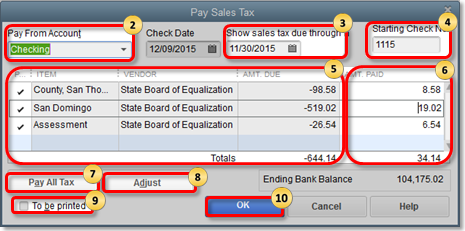

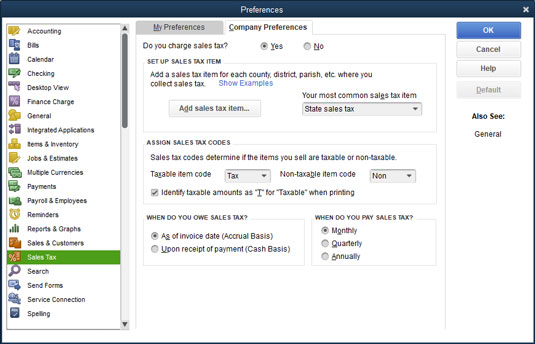

The Default tax code will be grayed out, and you can enter Exemption details in that field.Ĭustomer records for exempt organizations should contain details for that exemption. Click the Tax info tab and make sure there’s no checkmark in the box that says This customer is taxable. Open a customer record and click the Edit link in the upper right. You’ll need to edit their customer records to reflect this in QBO. Some customers (like nonprofit organizations) do not have to pay sales tax. If your business is located in Florida and you sell to a customer in Minnesota, you’ll be charging any sales tax levied by the state of Minnesota and possibly the city and county and other taxing authorities – if you have a connection, a “nexus” in that state (a physical location, active salesperson, etc.). QuickBooks Online calculates sales tax rates based on: That said, here are five things we think you should know. Taxing agencies can audit your recordkeeping and you want to make sure it is set up correctly. If you’re not already working with sales taxes, we strongly recommend you let us help you get everything set up correctly from the start. This is one of the most complicated areas in QuickBooks Online because you may have to deal with numerous taxing agencies. Further, it calculates how much you must pay to state and local taxing agencies. QuickBooks Online offers tools that allow you to set up sales tax rates and include sales tax on sales forms. But most businesses have a wider reach than that. If you sold only one type of product to customers in one city, collecting and paying sales tax would be easy. The most important thing you need to know about sales tax is that administering it correctly can be challenging.

0 kommentar(er)

0 kommentar(er)